How to Deal with an Underpaid Invoice (Short Paid Invoice) in Ireland

The situation of an underpaid invoice occurs when the customer does not make full payment in comparison to the total amount of the invoice. To put it another way, it is when the payment received from the customer is less than the agreed amount and this is known as an underpaid invoice or a short paid invoice.

Whether the invoice is underpaid or not, can be discovered by comparing the payment received with the invoice sent to the customer.

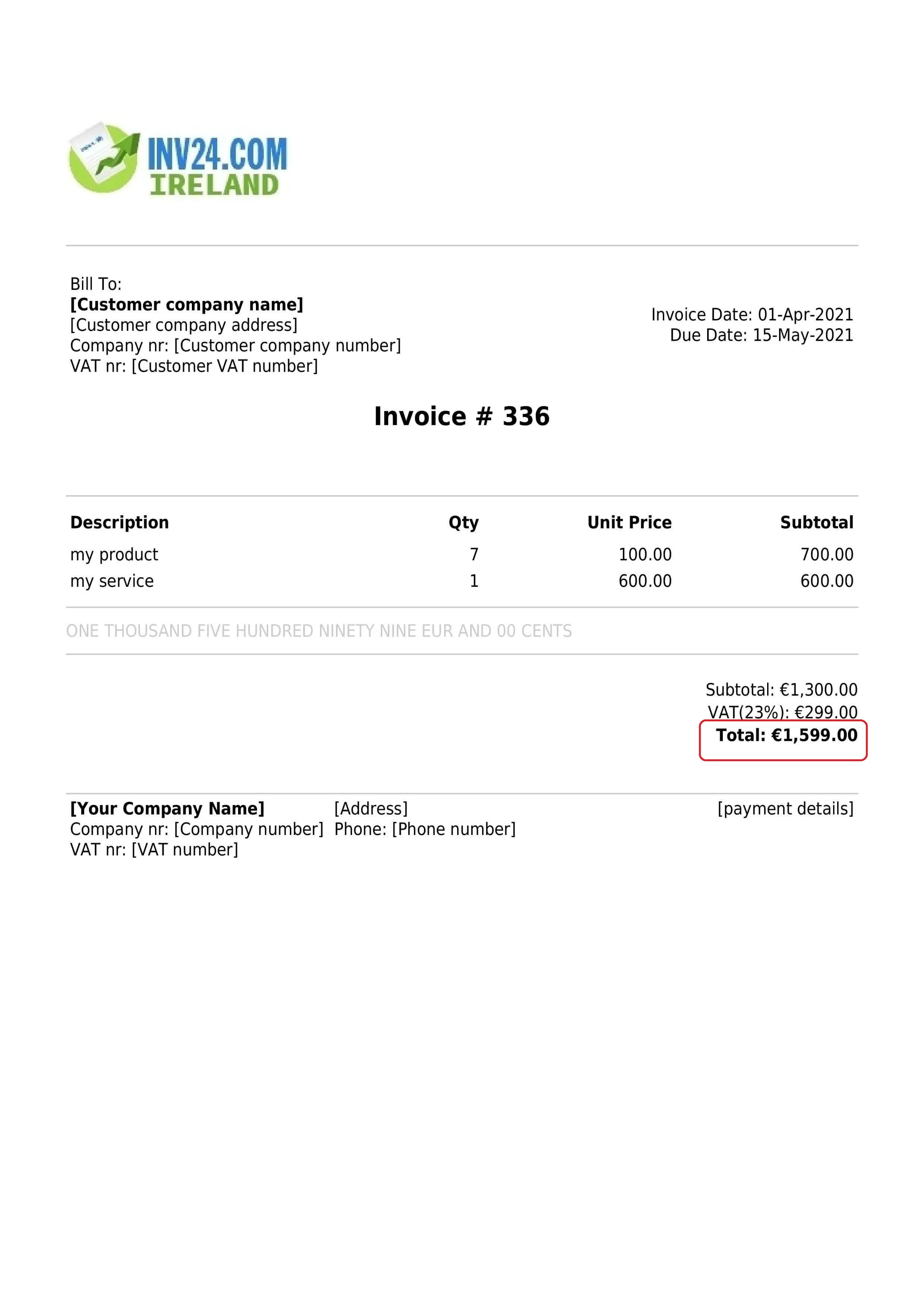

Example

Take the example of when a customer has agreed to pay €1,000 for product A, but has instead, paid €800. This means that the invoice is underpaid by €200 (€1,000 - €800).

This situation is referred to as an underpaid invoice. So, the next question that arises is, what are the reasons for underpaid invoices?

What are the Reasons for an Underpayment?

There are various reasons for an underpaid invoice and some are as follows:

Error on the invoice

The seller may send an overstated invoice due to an error in entering the price in the invoice. For instance, the seller may accidentally enter an excess price in the invoice than what was agreed in the contract, leading to an underpaid invoice. This mistake will need to have a correction posted in the books of the seller.

Error during payment transaction

The customer may make a mistake when manually transferring the funds for the purchase. This means that the customer will need to be informed about the wrong amount.

Understanding gap

This occurs when the customer is not able to locate the exact payment amount on the invoice. For example, they may pay the net amount instead of the gross amount. This often occurs when the customer is not able to read and understand the invoice amount appropriately.

A dispute raised by the customer

This happens when the customer raises some concerns about the quality of the products delivered to them. Since they are not happy with the goods, they may decide to make a partial payment instead of a full payment.

Customer is facing financial difficulty

When a customer faces some kind of financial difficulty, they may be unable to make the full payment. In this scenario, they may decide to make a partial payment on the invoice.

Some ongoing negotiation

Sometimes, the seller may have sent an invoice to the customer before obtaining final approval of the price from the customer. This might mean that the customer is expecting a lower priced invoice and this situation may ultimately develop into an underpaid invoice. To avoid this situation, it is imperative to ensure that both parties are agreed on the terms and conditions before the invoice is generated.

All of the above situations may result in underpaid invoices. However, these kinds of situations can be resolved by open communication and negotiation. Following will be a discussion on how to handle underpayments from the perspective of the seller and buyer.

How do you Handle Underpayments from the Seller's perspective?

Often times, it can be frustrating and challenging to handle underpayments from the seller’s perspective. The best approach is to resolve the matter by communicating and understanding the customer’s point of view. It is important to realize that there is no need to panic, but to handle the situation diligently.

Following are the steps to take to handle this situation amicably:

Verify underpayment

The first step involves the verification of your claim for the underpayment. This verification can be done by comparing the payment amount with the invoice to confirm whether the amount billed or invoiced to the customer is more than the payment that has been received. When the underpayment of the invoice is verified, the next step is to communicate this underpayment to the buyer.

Diligently communicate the situation to the buyer

Politely explain to the customer that there has been a discrepancy in the recent payment that has been received from them. It will further your case, if you mention specific numbers for the bill and payment and supporting documents can be attached for their review and consideration. For example, the relevant invoice and payment receipt can be presented which will highlight the difference as an underpayment. To stay organized, it is wise to mention the amount invoiced, the payment received and the resulting underpayment. This will facilitate the customer in the next steps.

Define the deadline for the additional payment

Even though the dialogue with the customer should remain professional and show gratefulness, the seller will need to provide a deadline for the remaining payment. This will create an element of urgency at the buyer’s end and will make them consider the matter as a priority.

Maintain professionalism

An underpayment may be a result of an understanding gap at the customer’s end. It is vital to maintain a professional impression throughout the process so that it will not lead to an impairment of the working relationship with the customer. Despite this, you can opt to explain the consequences if the matter does not get resolved, especially in the case that the products have already been delivered, or the services have already been performed for the customer.

Consider taking legal action

Taking legal action should be considered as the last resort. However, it may have to be taken if you have been unable to recover the underpayment, despite reasonable reminders, or emails, and recovery attempts.

It is important to ensure a solution-oriented approach throughout the recovery process and attempt to facilitate the client into making the payment. The following example of an email template can be effective when sending underpayment notifications to the customer.

Email Template for Underpayment (Seller’s Perspective)

Dear {Name of the customer},

This email intends to communicate that we have identified an underpayment in the invoice # {XXX} paid on {DATE}. Following are the details of the discrepancies.

Invoice & payment details:

- Invoiced amount: {AAAA}

- Payment received: {BBBB}

- Underpayment amount: {CCCC}

We understand that this underpayment may be the result of some error or understanding gap. So, we are open to understanding if you have anything to explain in the context of underpayment. However, if the underpayment stands on some error, we request that you to make the remaining payment as soon as possible.

Payment instructions:

- Payment amount: {Underpaid amount on invoice}

- Payment method: {Bank account number or some other detail}

- Deadline for payment: {Specify the date to get paid}

We are committed to ensuring your satisfaction and appreciate the solution to the problem as soon as possible. If you have any questions or queries, please reach out us at {Your email / phone number}.

Thank you!

{Your name}

{Your post in the company}

{Your company name}

Accounting Perspective of Handling Underpayment (Seller’s Books)

Next will be a discussion on the accounting aspects of handling the underpayment:

Recording invoice for the sales/revenue (invoice is recorded with full amount)

The invoice is recorded with the full amount as sales or revenue. In other words, sales are credited, and accounts receivable are debited in the accounting books. This results in the following entry being recorded in the books:

Description Debit Credit Accounts Receivable XXX Sales/Revenue XXX The debit impact of the above transaction is recording for the receivable which is an asset. This is because the settlement of receivables will lead to an inflow of economic benefits in the future. On the other hand, the credit impact is to records sales. This is because the business has generated economic activity by selling the products or services.

Record the actual amount received

It is important to ensure that you record the amount that has actually been received. In other words, if you have received a partial amount against a specific invoice, you will need to record the exact, partial amount. In this way, an underpaid amount remains as receivable in the books of accounting. The following journal entry is posted in the books:

Description Debit Credit Bank XXX Accounts receivable XXX The debit impact of the transaction is the recording of funds received in the business bank account. On the other side of the transaction, the credit impact is to reduce accounts receivable with the amount that is received from the customer.

If the customer makes a partial payment, it then reduces the receivables by the extent of payment received. However, if the customer makes payment for the underpaid or remaining balance subsequently, the invoice is marked as closed and the receivable is removed from the books. The important and key concept to note, is that an invoice is only closed once it has been received in full.

However, if the customer pays a partial payment and does not make or intend to make the remaining payment, this might signal that it may need to be handled with bad debts or write offs.

Consider if you will have an underpaid amount as bad debt

A situation could occur where you believe that the customer is not expected to, or has no intention to pay the remaining or underpaid balance. In this case, you may consider providing a provision for this amount or write off receivables.

This means that if you are having doubts about getting paid you may opt to provide provisions by posting the following journal entry in the accounting books:

Description Debit Credit Bad debt expense XXX Allowance for the doubtful receivables XXX The debit impact of the transaction is to record expenses, as there is a need to record the removal of economic benefits from the books. On the other hand, the credit impact is to record allowance for doubtful receivables, which is a contra account of the assets. So, it is important to note that both assets (receivable) and contra assets (allowance) remain on the balance sheet at this time.

However, once receivables are removed from the books, the following journal entry is posted in the accounts:

Description Debit Credit Allowance for the doubtful receivables XXX Accounts receivable XXX The debit impact of the transaction is to remove allowance for doubtful receivables. This is because we had created this temporary account with the intention of removing it, when writing off the receivables from the books. Similarly, the credit impact records the removal of the receivable for which bad debt expense was originally created.

Keep monitoring the operations

It is a wise business decision to implement strong internal controls and procedures to avoid any underpayments in the future. This is especially so, when the error was due to some sort of mistake from your end. The billing process must be thoroughly reviewed, so that gaps and weaknesses are identified and communication with the client is improved. This is because they are only invoiced for the agreed price in the contract.

Further, if you are the customer and you discover an underpayment, the following content can be helpful.

How do you Handle Underpayments From the Customer's Perspective?

It is comparatively easier to handle the situation when you notice an underpayment as a customer. It is called an underpayment, when as a customer, you have noticed that the amount that you have paid, is less than the agreed amount.

Following will be some tips on how to tackle this situation diligently:

Review the invoice and payment made

The first step is to review the total amount in the invoice and compare this along side the payment that you have made to the supplier. As explained above, if you notice that the payment that you have made to the supplier is less than the amount on the invoice, it is known as an underpayment.

Acknowledge the mistake

After reviewing the document and verifying the underpayment, it is time to acknowledge the mistake at your end, take ownership of it, and then communicate with the seller about the situation.

Clearly communicate the underpayment to the seller

It is good to be transparent and open when communicating and sharing details with the supplier. In addition, so that there is no confusion at the seller’s end, it is better to include the amount of the invoice, the payment and underpayment details with the supplier.

Be apologetic as there was an error or oversight on your part

To maintain a good business relationship with the supplier, it is helpful to express your understanding with the supplier about the underpayment and also assure the supplier that you will be taking prompt action to make the remaining payment.

Make sure to document all the communication

It makes good business sense to keep a sorted and organized record of all the communication that you have made with the supplier in regards to the underpayment. For example, details about the invoice, payment receipt, underpayment, communication with the supplier and their response, final payment and confirmation should all be recorded for documentation purposes. This documentation of all the correspondence with help to keep a back up and also will prove your position at the time of the tax and financial audit. It is also recommended to send all communication in writing, such as by sending emails, so that the correspondence is recorded.

If you opt to send an email for the underpayment, the following template can be effective and helpful.

Email Template for an Underpayment (Customer’s Perspective)

Dear {Name of the seller},

We are writing this email to communicate that there has been some discrepancy in the recent payment that we have made under the invoice number {XXX} paid on dated {DATE}.

The amount we paid was less than the amount billed to us with the following details.

Payment details:

- Invoice number {XXXX}

- Invoiced amount: {AAAA}

- Amount paid: {BBBB}

- Amount underpaid: {CCCC}

If an underpayment is confirmed, we assure you that we will make the balance of payment as soon as possible without any delay. Additionally, please let us know if you have any set SOPs (Standard Operating Procedures) to deal with such types of situations.

We thank you for your cooperation and coordination and look forward to hearing back and assisting in the correction process. Please reach out to us at {Your email / phone number}.

Thank you!

{Your name}

{Your post in the company}

{Your company name}

Next will be a discussion about the accounting aspects of handling the underpayment.

Accounting Perspective of Handling Underpayment (Customer’s Books)

The following steps can be effective when handling the accounting from a customer's perspective, once you discover an underpayment on the invoice:

Obtain supporting documents

Supporting documents should be obtained and gathered together, such as the purchase invoice, the proof of partial payment which can be seen on the bank statement and checks. It is important that the numbers in the accounting system must be the same as in the source documents listed above.

Ensure that the underpayment has now been paid

Review supporting documents, such as the bank statement and checks, to prove that the balance has been paid.

Record the payment and close the invoice

The final payment made to the supplier should be recorded and the specific invoice needs to be closed. There may be a requirement to debit accounts payable and credit the cash account to mark the invoice as paid.

Can the Late Fees be Charged in Case of an Underpayment or an Overdue Amount?

Whether you can charge late fees on an under or overdue balance is dependent on whether you have included a late fee provision in the terms and conditions of the contract or agreement that you have with the customer. Businesses do frequently use late fee provisions in the contract with customers in order to enhance their cash flow management and liquidity.

The following points should be carefully thought of, if a business is considering whether to collect late fees from a customer:

Legal regulations and compliance

Careful consideration must be made about the national regulations concerning the collection of late fees. The regulations will be different for different jurisdictions. This means that there is a need to research the local rules and regulations that are applicable to the business.

Working relationship and flexibility

A seller may decide that they do not wish to charge late fees for their customers because they want to keep strong working relations with the customer. This kind of thinking is because the seller might believe that charging a late fee will lead to a loss of future business and that it may impair the working relations with the customer.

Conclusion

An invoice is deemed underpaid when the customer does not make the payment in full. There are various reasons for an underpayment of an invoice with include, errors, disputes, customer financial difficulty, misunderstandings, ongoing negotiation as well as others.

The approach to take in the situation of underpaid invoices is to have clear and transparent communication. There will be a need to understand why the invoice was underpaid, so that this situation can be avoided in the future. The underpayment of the invoice may be identified at both the seller’s and buyer’s end.

As noted above, the seller is entitled to charge interest on the underpaid or overdue amount. However, this is dependent on whether there is a provision for the late fee in the contract with the customer. In addition, legal regulations and the working relationship between the seller and customer also plays a significant role in the decision on whether to collect interest fees on the underpaid or overdue invoice.

CREATE INVOICE ONLINE

Invoicing Tools for Ireland: