Debit Note

What is a Debit Note?

A debit note, also known as a debit invoice, is used in the following two scenarios:

- A debit note is a document which is sent by the vendor to the buyer to inform them of a current debt obligation. The purpose for issuing the debit note may be to remind the buyer that there is a payment amount due.

- A debit note is a document that is sent by the buyer to the vendor when they would like to request an adjustment of the amount that has been invoiced to them. The reason for the adjustment may be due to faulty goods which they would like to return, or an accounting error and so forth. The debit note will generally contain the amount of inventory to be returned as well as the reason for the return. It can therefore be used as supporting documentation when posting an entry for the purchase return.

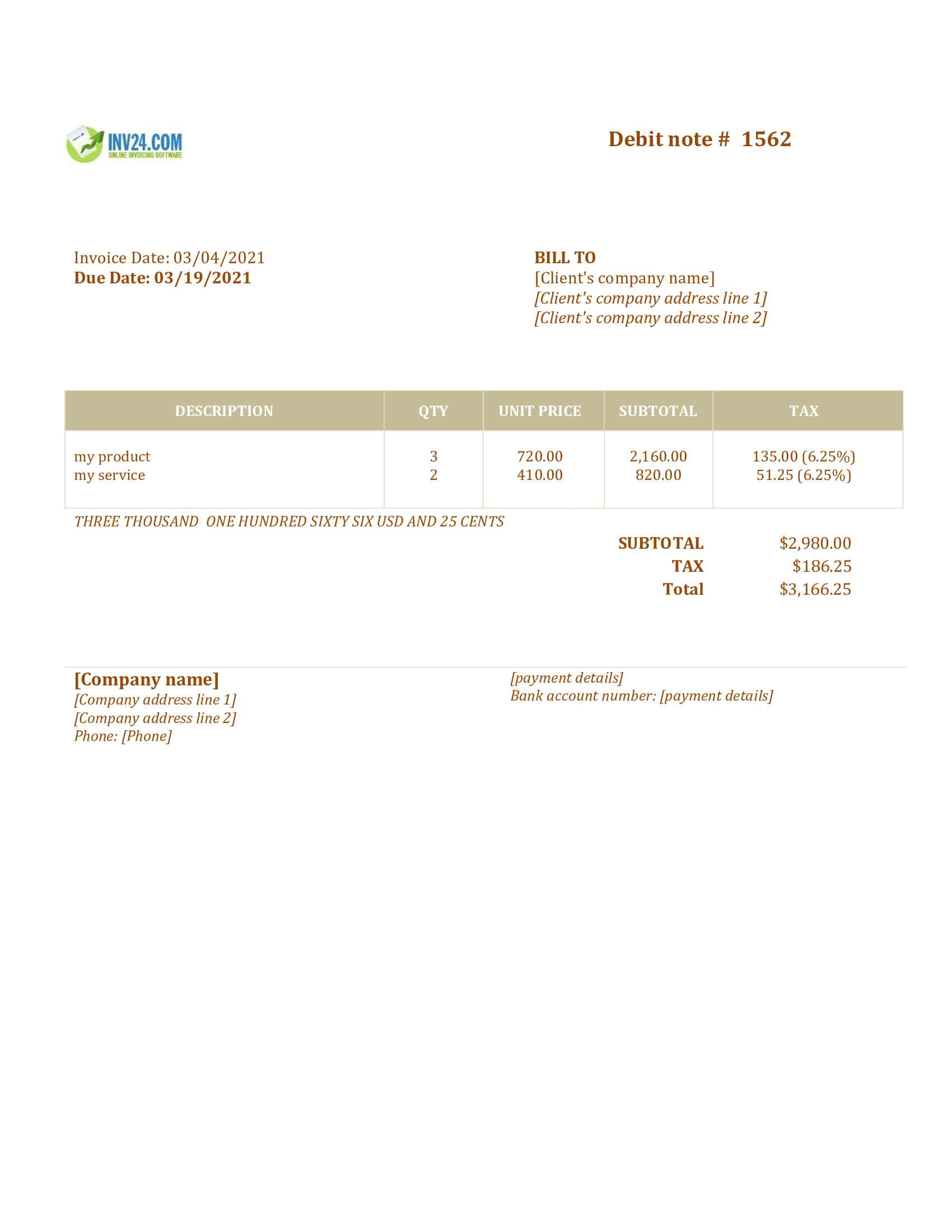

Debit Note Example

How to Create a Debit Note

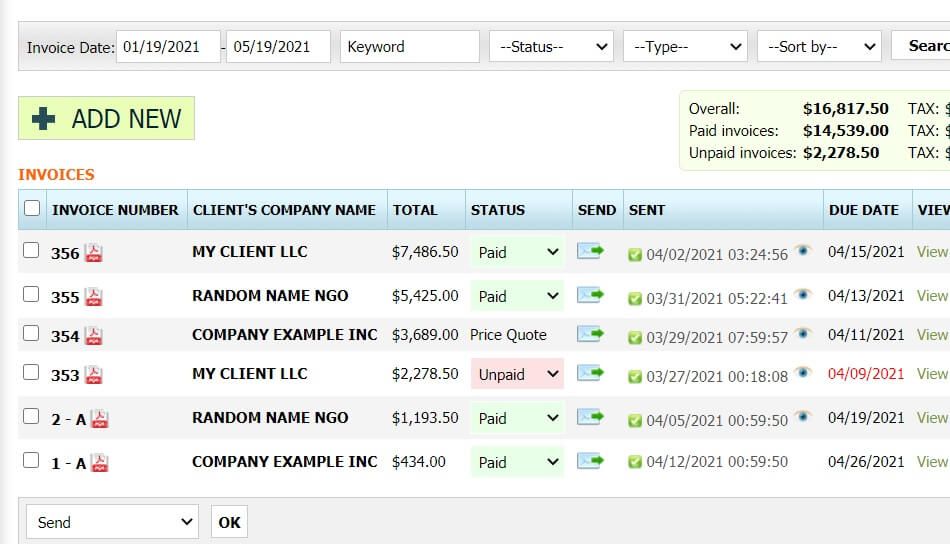

Method 1: Use our simple invoice software

- Try It Free

- When you add invoice, set invoice type to “Debit note”

- You can copy and convert an invoice into a debit note in just a few clicks

-

Method 2: Download a free debit note template:

When a Debit Note is Issued

A debit note can be issued in multiple scenarios, however, it needs to be supported by the buyer’s intention to return the goods. Following, are some potential scenarios of when a debit note is issued:

- The goods received by the buyer are defective, or of low or sub-standard quality.

- The price charged by the vendor was higher than the agreed or normal market price.

- There was some error in the invoice which meant that a higher amount was invoiced to the buyer. In this case, this needs to be adjusted in the accounting records.

Debit Note Example (Customer Issued)

Company A purchases 500 hard drives from Company B at $70 each, on credit. On inspection, the quality inspection manager at Company A noticed that 100 hard drives were damaged on delivery. Hence, they decide to return the defective hard drives. In this case, Company A needs to issue a debit note with the following information:

Amount of return or adjustment

The amount for the return would be $7,000 (100 x $70).

Reason for the adjustment or return

Defective goods.

Product reference details

Invoice reference number for the purchase of the original 500 hard drives.

When the debit note with all pertinent information as well as the defective hard drives are sent to company B, they will need to verify the claim. If they accept the claim, a credit note will be issued to the customer to communicate their acceptance. This then completes the process of adjustment with the debit note.

Furthermore, as explained previously, it should be noted that there are two types of debit notes. The first is when a supplier issues a debit note to communicate a debt status to a customer and the second is a request for an adjustment in the invoice value by the customer. Hence, there is a difference between invoice and debit notes. Following is an in-depth explanation of the difference between invoice and debit notes.

Debit Note vs Invoice

Following are the difference between debit notes issued by the seller, and invoices.

A debit note is sent to the customer to remind them of the due balance. The purpose is to collect the overdue balance. On the other hand an invoice is issued when a sale transaction occurs. Therefore, a debit note is based on the accounts receivable balance while an invoice is based on the value of the sale. An invoice is issued during normal business when a sale is made.

Furthermore, it is important to note that the customer issues the second type of debit note to the supplier for requesting adjustments in the invoiced amount. It therefore reduces the accounts receivable balance in the seller’s books whereas an issue of an invoice leads to an increase in the accounts receivable balance in the seller’s books since a sale has been made.

Similarly, a debit note is issued when there are defective goods or returns.

Debit Note vs Credit Note

Following are the main differences between a debit note and a credit note:

| Debit note | Credit note |

| The customer issues a debit note to request an adjustment in the invoice already received. | A credit note is issued by the supplier or seller of the goods. It is issued as a signal that acceptance of a debit note is received. |

| If a debit note is accepted, it leads to a reduction in the creditor balance in the buyer's books. | The issuance of a credit note leads to a reduction in the debtor balance in the supplier's books. |

| A debit note is recorded in a purchase return book. The buyer maintains these books. | The credit note is recorded in a sales return book. The seller maintains these books. |

| Amount for accounts payable is reduced in the books of the customer. That is why it is called a debit note. | The amount for accounts receivable is credited to the books of the supplier. That is why it is called a credit note. |

| The debit note can be issued when the customer has received faulty goods. It can also be issued in exchange for a credit note. | The credit note can be issued when debit note or defect claim is received. |

Debit Note as Accounting Support

A debit note is a document which is acceptable to be used as accounting support. In fact, it is the only support available for adjusting returns or if there is some error in an invoice that has already been issued. By recording debit notes, the amount of revenue changes in the seller's books. There will also be tax implications and corporation taxes will also change. As standard practice, there will be a requirement to store these documents to ensure compliance with regulations.

Sample Email Template for Debit Note

Hello {Name of the vendor},

This email intends to communicate that goods received on {DATE} against invoice # (YYY) have not been of the premium quality as ordered. Due to this, we have decided to return the shipment and have generated the attached debit note for the same.

You are kindly requested to issue a credit note for the invoice mentioned above, and we are ready to cooperate with the verification process.

Best regards,

{Your name}

{Your position in the company}

{Your company name}

{Your contact details}

Conclusion

There are two types of debit notes. The first is when a debit note is issued by the supplier to a buyer in order to collect a balance for goods for which payment is overdue. It aims to enhance collection and therefore, liquidity. The second type of invoice is issued by a customer to request an adjustment in the invoice received. It may be requested in order to return defective goods or some other error.

If a supplier approves the debit note, a credit note is then issued as a signal of acceptance of the return or error. The debit note acts as supporting documentation that reduces the debtor balance in the books of the supplier. On the contrary, a credit note acts as support for reducing the creditor balance in the buyer’s books.

The main different between invoices and debits notes is that an invoice is issued in the normal course of business when a sales transaction occurs. However a debit note is issued when some adjustment is required.

Frequently Asked Questions

What is a debit note in accounting?

Since a debit note is a document issued by the buyer requesting an adjustment in the invoice received, it may mean that the request for adjustment is based on some accounting error or defective goods. If a debit note is accepted, it reduces liability for the customer and the debtor balance of the supplier.

What is the journal entry for recording debit notes in the books of the seller and buyer?

Following is a journal entry for recording debit notes in the books of the seller.

| Particulars | Debit | Credit |

| Sales return | XXX | |

| Accounts receivable | XXX |

There is a debit impact of the transaction because sales are reduced since defective items have been returned. The credit impact of the entry is a reduced debtor balance.

Similarly, the following journal entry is posted in the books of the buyer.

| Particulars | Debit | Credit |

| Accounts payable | XXX | |

| Purchase return | XXX |

The debit impact of the transaction is reduced liability as defective goods have been returned. On the other side, the credit impact of the transaction records returns of the defective goods in the purchase ledger.

Who issues a debit note?

A supplier can issue a debit note to the customer to inform them about their current debt obligations, specifically when the customer has not paid an amount due. It can also be issued by the customer to the supplier to claim an adjustment for defective goods.

What are the main components of a debit note issued by the buyer?

There are three main components of a debit note issued by the buyer. These components include:

- Amount requested for the adjustment

- Reason for the adjustment

- The reference number of the invoice that needs to be adjusted

Why are auditors particularly interested in the area of debit and credit notes?

Debit and credit notes means that there is a need to make adjustments in the company’s accounting records through journal entries. There is a higher potential for errors or manipulations in the accounting system when records are adjusted. That is why this area may be scrutinised by auditors.

Other Types of Invoices:

- Standard Invoice: standard invoice issued by a tax payer

- Invoice for tax non-payer: standard invoice issued by a tax non-payer company

- Proforma invoice: simple request for payment

- Credit note: refunding a customer

- Recurring invoice: automatic invoicing a subscribing customer