Invoice with Bank Details

An invoice with bank details is when the invoice requests payment through a bank transfer. The payment through a bank transfer is the preferred choice of making payments as it is cost effective as well as efficient. Furthermore, it is considered a reliable and secure system of payment transmission.

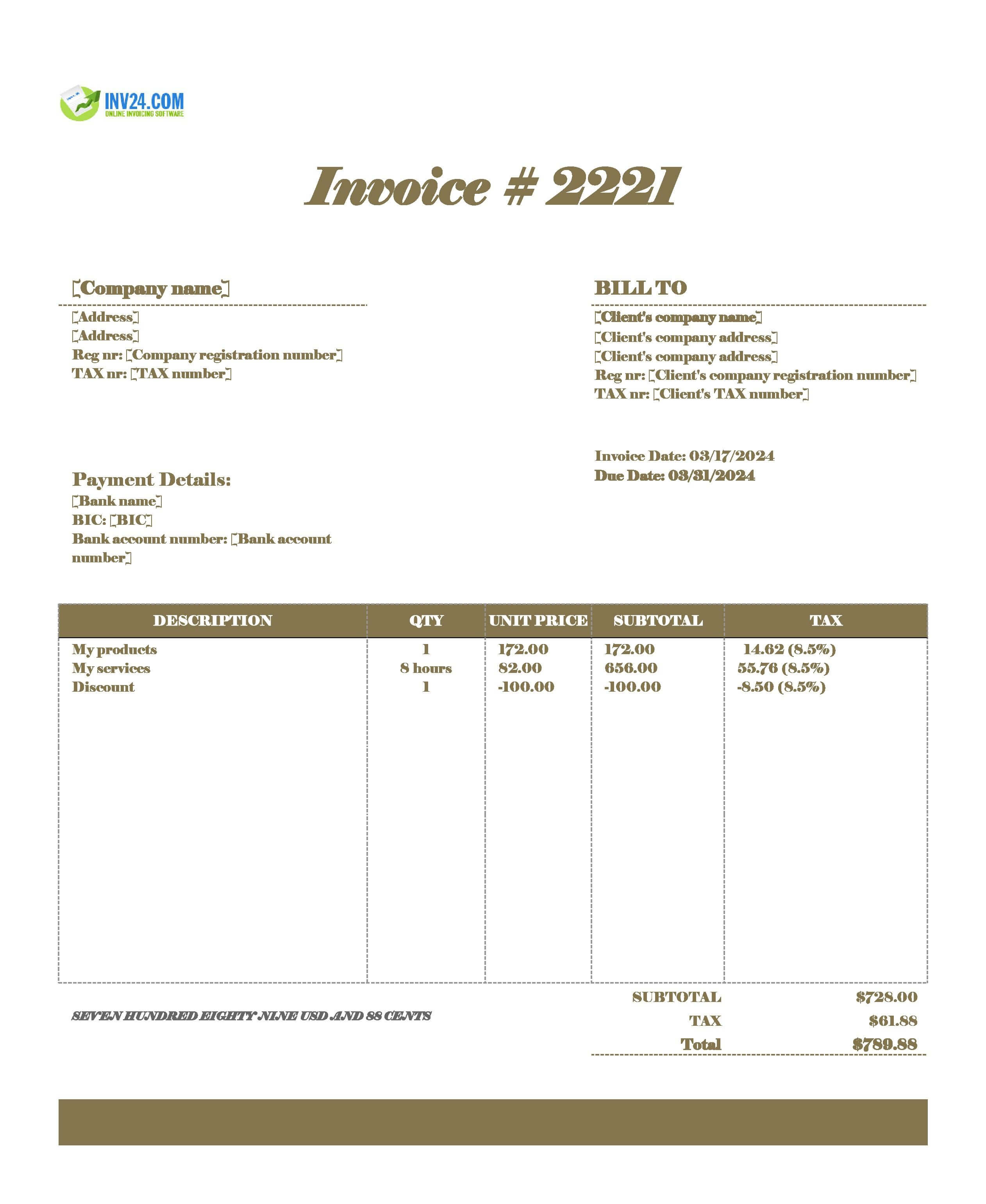

The bank details consist of:

- Bank Name

- Bank Account Number: business account number

- Bank Identifier Code (BIC): SWIFT / BSC / ACH / ABA

Advantages and Disadvantages

Next is a table that details the advantages and disadvantages of an invoice with bank details:

| Advantages | Disadvantages |

| Bank transfer is a highly efficient mode of payment and is considered more secure than paper-based checks and payment requests. | Not all customers are confident about sharing sensitive information on invoices such as bank account details. Hence, it may not be a feasible mode of payment in all cases. |

| The payment cycle moves around financial institutions, which helps in seamless payment processing without any manual interventions. | Executing a payment via bank transfer is impossible if any of the trading partners (seller or buyer) do not have a valid bank account number. |

| Bank payments can be linked with the accounting and billing system. It means that there is no need to post journal entries or mark the invoice once payment is received. | International payments are typically expensive. |

| The cost of transactions is lower when using bank payments instead of checks and payment via cards. This makes it a financially feasible idea to use bank payment. | There is a need to ensure regulatory compliance when using bank payments. |

How to Create an Invoice with Bank Details

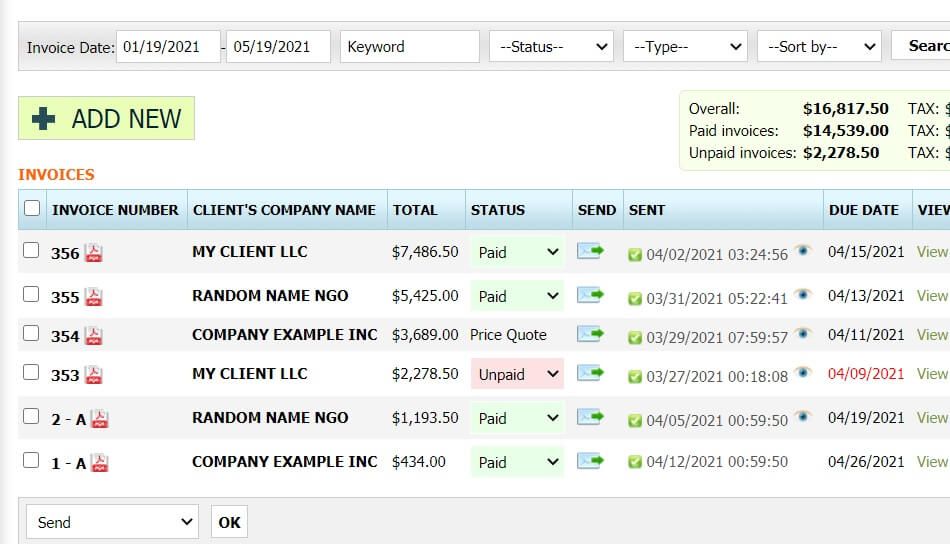

Method 1: Use our simple invoice software

Method 2: Download a free invoice with bank details template:

Invoicing tools: