Self-billing Invoice

A self-billing invoice is an arrangement where the buyer prepares and sends an invoice to the seller. The buyer prepares the invoice by basing it on the goods and services received from the supplier. It is important to note that while the buyer prepares the self-billing invoice, the seller will still need to review and validate it. Without the validation by the supplier, there will be no legal existence of a self-billing invoice.

An important point to note, is that the buyer can claim input tax on purchases based on a self-billing invoice. They will however, need to comply with certain conditions that include the following:

- This arrangement should be part of the agreement

- The agreement of self-billing invoices must be reviewed after regular intervals

- Details on the invoice should be error-free

- The customer is required to keep detailed records of the invoices that are issued

- Both the seller and buyer must retain copies of the self-billing invoices for tax and audit compliance

Benefits of a Self-billing Invoice

Benefits for Buyers

- The use of self-billing invoice helps to enhance process efficiency while also saving time. This is because the buyer does not need to rely on the seller to send invoices so that the buyer can make payment. Instead, they are empowered to generate invoices based on the goods that are received from suppliers.

- The buyer enjoys higher control on overall purchase transactions. This leads to enhanced integration with accounting and payment systems while also increasing transparency.

Benefits for Suppliers

- Self-billing from the buyer helps to improve the cash flow position of the seller. This is because there will be no delay or risk that invoices are sent out late. In other words, the use of self-billing will encourage the customers to make prompt payments.

- Administrative hustle is reduced as sellers are not required to generate and send the invoice.

How to Create a Self-billing Invoice

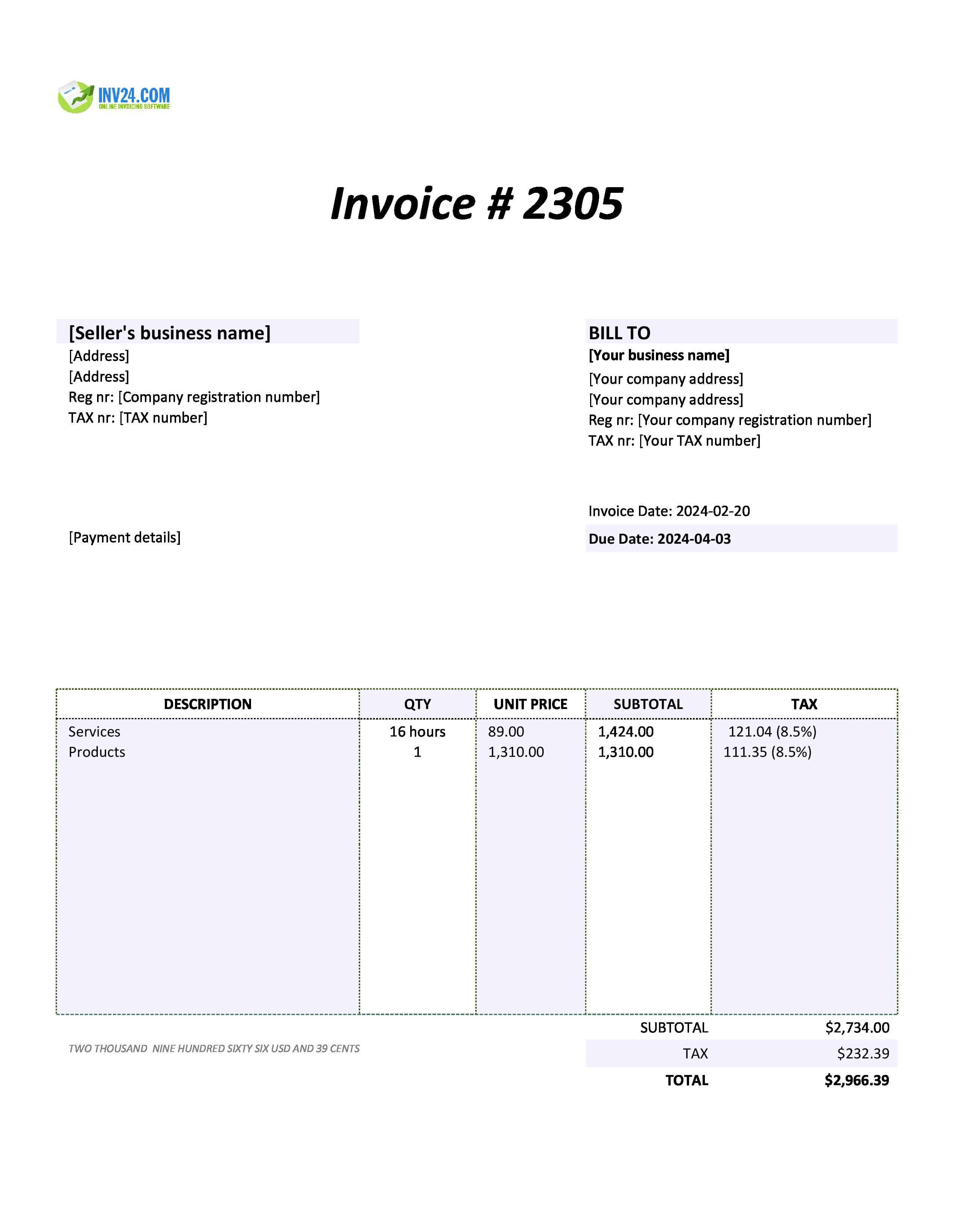

Download a free self-billing invoice template:

Invoicing tools: